In Case You Missed It

Upshot of Domestic Oil Boom: Fewer Shocks

WASHINGTON, D.C.,

June 20, 2014

|

Committee Press Office

(202-225-2761)

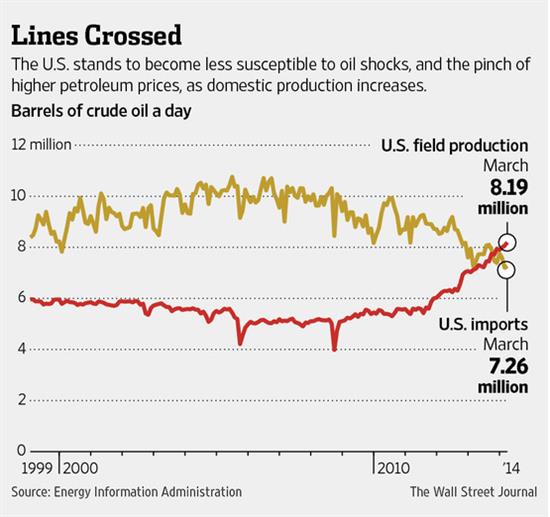

As the Wall Street Journal article below notes, increased U.S. oil production is the best way to protect our country from volatile gasoline price spikes caused by international conflicts, such as the current violence in Iraq. Next week, the U.S. House of Representatives will take further action to expand domestic energy production and improve our energy security by considering H.R. 4899, the Lowering Gasoline Prices to Fuel an America that Works Act. The bill will expand federal offshore and onshore energy production – creating over a million new jobs, easing the pain at the pump, and further lowering our dependence on foreign oil.

Upshot of Domestic Oil Boom: Fewer ShocksWall Street Journal The latest spasm of violence in the Middle East has sent crude-oil prices climbing in recent weeks, a familiar action-reaction that frequently has proved to be a drag on economic growth. Yet that dynamic figures to ease in coming months and years as U.S. dependence on Mideast oil is, by a variety of measures, at a generational nadir. In the current flare-up of unrest, Islamist militants have swept across northern Iraq, threatening Baghdad and spurring fears that violence could disrupt the country's 2.7 million barrels a day in exports. Amid this, the U.S. crude-oil benchmark on the New York Mercantile Exchange has climbed to around $107 a barrel, the highest level since September. The oil-price instability has been playing out broadly since late 2010, when a string of popular political revolutions across the Middle East drove up the price of crude to $113 a barrel from $85 over five months. Much has changed since the so-called Arab Spring to alter the U.S. energy picture. Advanced technologies such as hydraulic fracturing, or fracking, have boosted U.S. crude-oil production by 47% since late 2010. Domestic U.S. oil production in October surpassed imports for the first time in nearly two decades, putting slack into the global oil market and making more crude available at lower prices to countries like China and India. Canada, too, has made great gains in oil production, so that the U.S. now imports about as much oil from its northern neighbor as from all of the Organization of the Petroleum Exporting Countries, meaning that the Middle East's importance to the U.S. energy supply has shrunk. Better fuel economy has also left many consumers less sensitive to oil prices. For model year 2013, vehicles had average mileage of 24 miles a gallon, up 6% from 2010 and 22% from a decade ago. "The U.S. is less vulnerable to oil shocks," said Brian Levitt, senior economist at OppenheimerFunds. "Over time, there's going to be less and less vulnerability to events in the Middle East." That's not to say the U.S. is invulnerable. The nation still imports more than 7 million barrels a day of crude oil, and for many Americans, the amount of gasoline they consume is largely determined by the length of their commute. Higher gas prices—now at a national average of $3.69 a gallon, up 11% since the start of the year, according to the Energy Information Administration—can take a bite from consumer spending elsewhere. An increase of just $10 a barrel in the price of oil over three months would reduce U.S. gross domestic product by about 0.2 percentage point, according to Joseph LaVorgna, chief U.S. economist at Deutsche Bank. Higher oil prices are "a risk factor and one that we're taking very seriously," said Jason Furman, chairman of the White House Council of Economic Advisers, speaking Tuesday at a CFO Network event hosted by The Wall Street Journal. Increased domestic oil production and more-efficient cars mean the U.S. is more insulated from oil shocks than in past decades, he said, "but no one is fully insulated." Still, while climbing oil prices would hurt U.S. consumers, any increase would benefit U.S. energy producers, providing a partial offset for the overall U.S. economy, according to Jason Schenker, the president of Prestige Economics in Austin, Texas. "Because we're importing less, the risks to a widening trade deficit are somewhat diminished," he said, referring to the reduced need to import foreign oil. And there are potentially gains "from a corporate-profit standpoint" now that more U.S. firms and workers stand to gain when oil prices rise. Before the latest spread of violence, Iraq was producing around 3.45 million barrels a day, less than half of what the U.S. currently produces and about 4% of world supply. Of that, 2.7 million barrels went onto the export market last month, according to the International Energy Agency. Iraq has already suffered some setbacks on the oil front. An attack in March took 340,000 barrels a day off line. Repeated insurgent attacks have shut down the Kirkuk-to-Ceyhan oil pipeline that transports oil from northern Iraq to Turkey. But the majority of the country's oil production is in the south, still well out of the zone of sectarian fighting north of Baghdad.

### |

Newsletter Sign Up

Sign up to receive news, updates and insights directly to your inbox.